How much does it cost to just get by in your community?

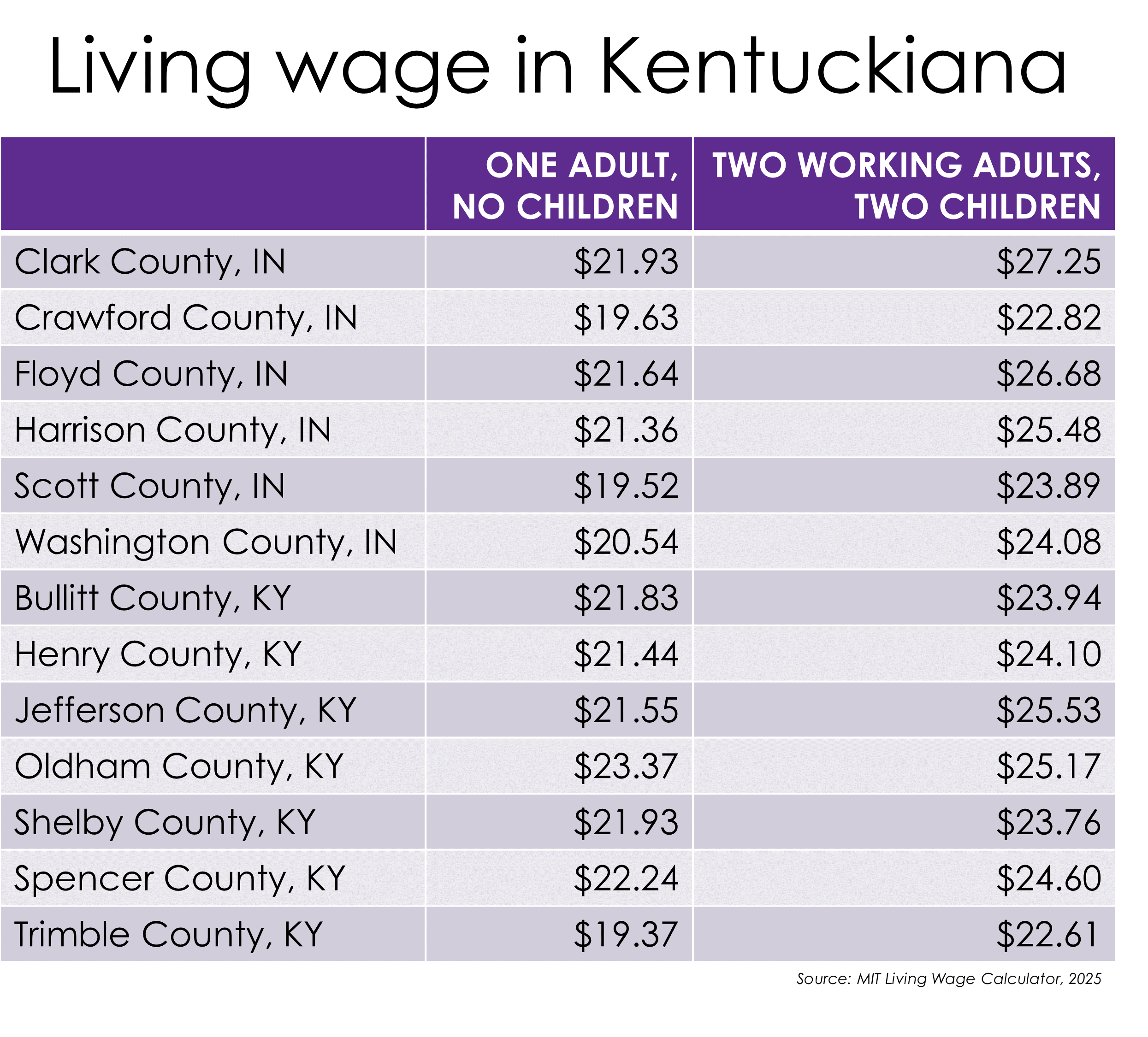

Many workers in low-wage jobs do not earn enough to meet their basic needs in the community in which they live. Researchers at MIT developed the Living Wage Calculator using current data and covering modern-day expenses, to provide communities with an understanding of how much it costs a full-time worker to meet their basic needs. The Calculator was recently updated with the latest data. Workers in the Kentuckiana region need to earn more than $19 per hour in a full-time, year-round job to maintain economic self-sufficiency. Depending on the county in which the worker lives, and their household size, this could range up to $27 per hour.

The living wage is the minimum threshold needed to maintain economic self-sufficiency without the use of public assistance programs and without facing severe housing or food insecurity. It does not account for expenses that many families would consider standard enjoyments, such as eating out at restaurants or taking a vacation. It also does not account for any savings or investment, including retirement savings or emergency expenses. It covers eight basic needs - food, childcare (when applicable), healthcare, housing, transportation, civic engagement, broadband, and other necessities, with an additional cost associated with income and payroll taxes. It assumes a person works a full-time, year-round job, 2080 hours per year. According to Lightcast data, 55% of the region’s jobs are in occupations that typically provide a living wage for a single adult with no dependents, more than 380,000 jobs. About 270,000 of those jobs, 39% of all jobs, typically provide a family supporting wage.

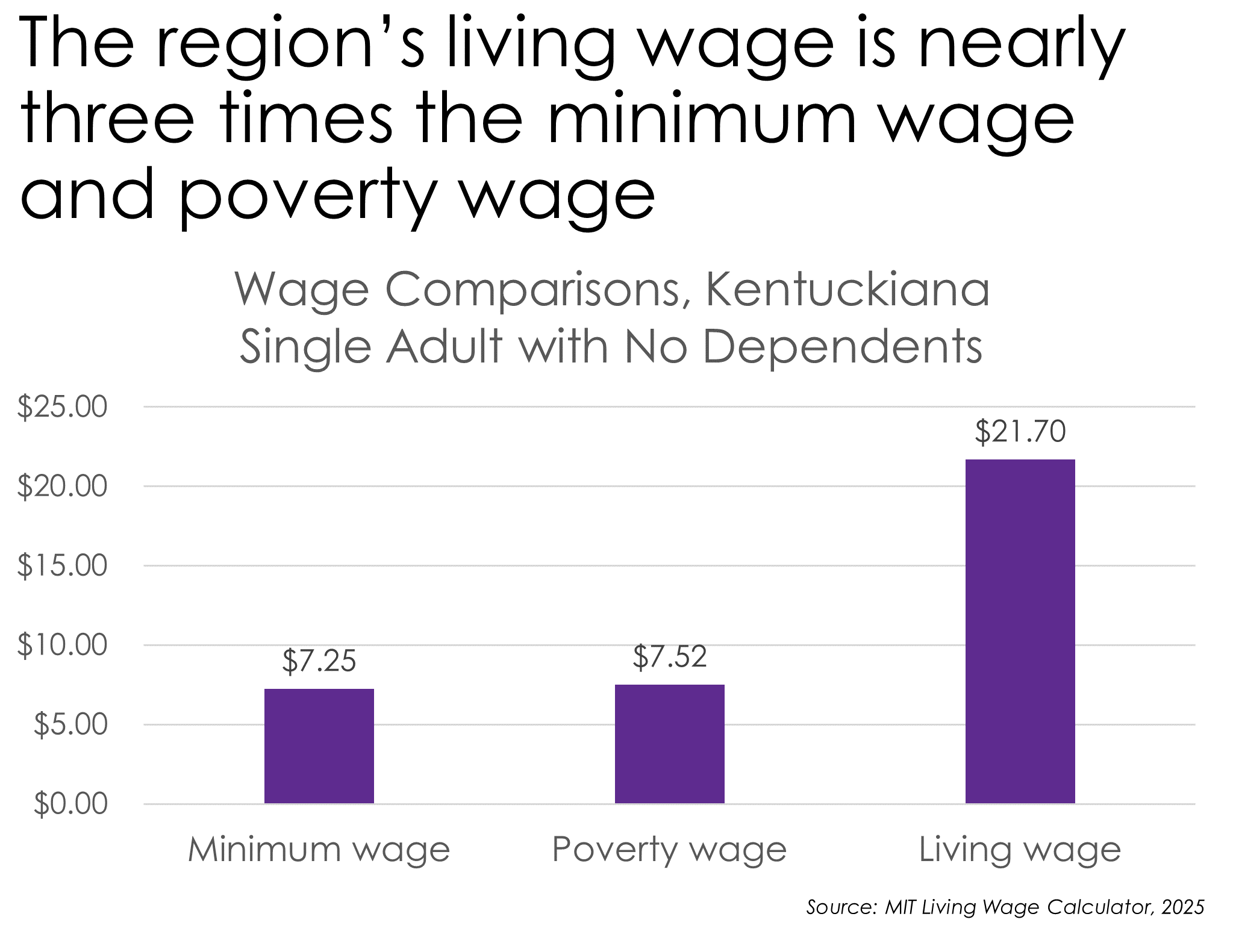

Other standards are often used to measure whether or not a person or household earns enough for a suitable standard of living. The minimum wage was last updated in 2009, up to $7.25 per hour. After adjusting for inflation, the minimum wage is equivalent to less than $5 per hour in today’s economy, nearly a third less than it was in 2009. Poverty guidelines rely on an outdated methodology, simply tripling a low-cost food budget. It does not incorporate any data on the current costs of housing, childcare, or healthcare. These outdated standards are much lower than the living wage.

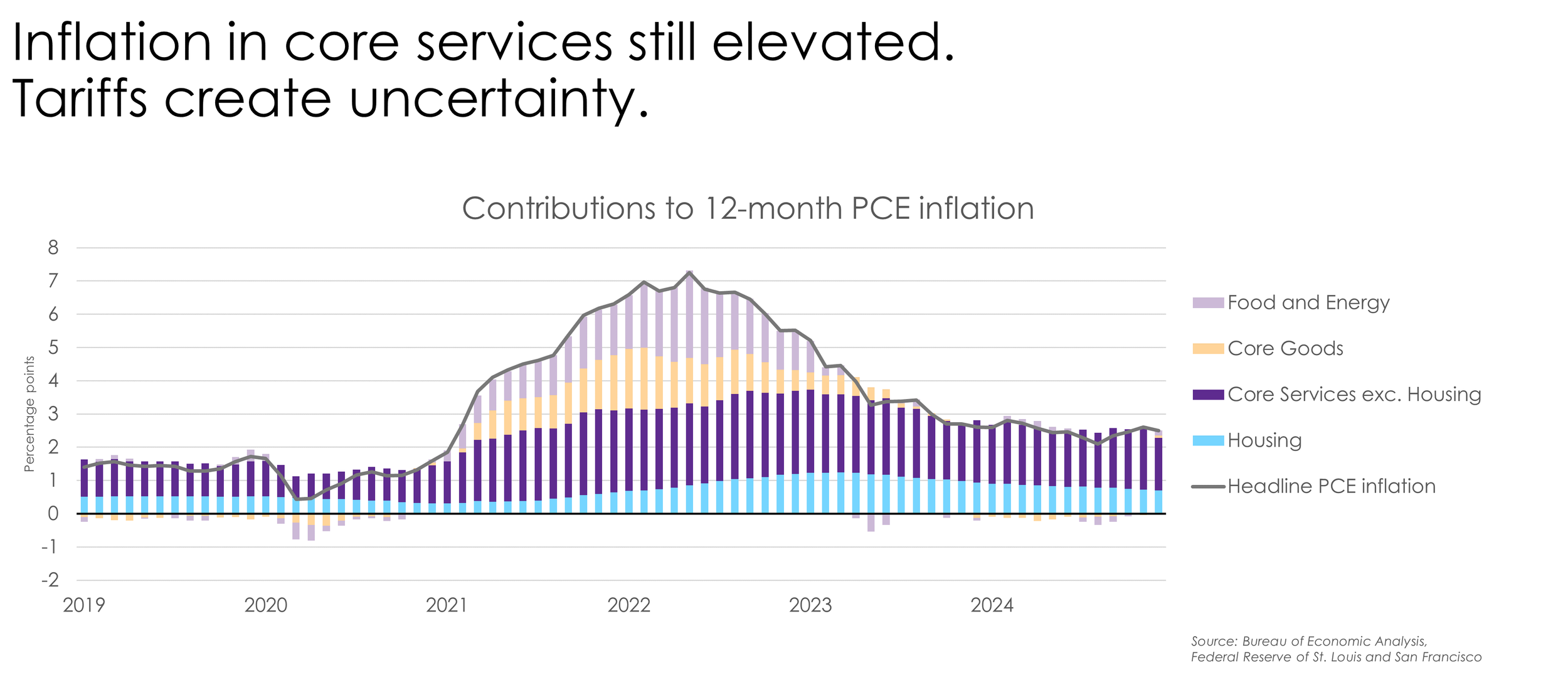

Price increases, or inflation, have been significant in recent years. Price increases were initially driven by goods, impacted by consumer preferences during the pandemic and supply chain issues, and food and energy, impacted by Russia’s invasion of Ukraine. Now, inflation remains elevated in services and housing. These are expenses that are difficult to condense, as they comprise a large part of an individual’s basic needs. These price increases have led to a higher living wage needed to maintain economic self-sufficiency. With a trade war on the horizon, it is likely that workers will be met with further price increases, necessitating an even higher living wage just to make ends meet.

Explore the living wage in your community for various household sizes here.